PICK YOUR POSION ECONOMICS

- docmikegreene

- Dec 23, 2022

- 5 min read

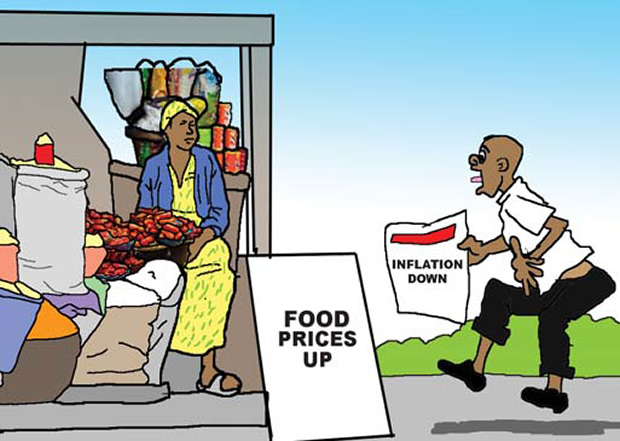

The inflationary fever may have finally broken. According to the most recent data, prices are now increasing at a rate of 7.1% per annum, substantially below the 7.8% annual rate that was reported in October. This increase was less than the 7.3% economists had been expecting.

What’s more, core inflation—which excludes volatile “stuff” like food and energy whose prices jump around quite a bit— also appears to be on the decline: This metric registered a drop from 6.3% to 6.0% per annum.

This drop in the pace at which the aggregate price level is increasing is good news. And, if it holds up, it’s especially good news for those households stuck on the lower rungs of the economic ladder.

Why so?

Because recent research indicates that inflation hits the pockets and well-being of poor households differently and harder than it does households higher up the income scale.

Here’s two findings that are particularly germane to this blog:

Low income are significantly more likely than higher income households to cite inflation as causing them a financial hardship: 3 out of every ten households with incomes below $40,000 said that inflation was causing them severe financial hardships. For households pulling in at least $100,000, only 2 percent reported experiencing severe financial hardship as a result of inflation.

Black households are disproportionately pummeled by rising prices: Compared to their White counterparts, goods and services with volatile prices — like rent and utilities— constitute a larger percentage of the typical Black household’s budget. Thus, Black households have less certainity as to how much their income is going to buy as inflation continues and, correspondingly, they are less able to plan and recalibrate their spending in response to rising prices.

What these and related findings underscore is this: Different groups experience inflation differently.

Inflation hits Black and lower income households especially hard. It stands to reason, then, that a decline in our current bout of inflation will lift an especially heavy financial burden off the shoulders of these very households.

All of which—surprise!—brings us to Jerome Powell and the Federal Reserve.

IT’S ALL ABOUT HOW

Just a week ago or so, the Federal Reserve’s Federal Open Market Committee (FOMC) closed the year out with yet another increase in its benchmark interest rate. This time the rate increase— 5 basis points or 1/2 of a percentage point— was less than the previous four increases of 75 basis points (3/4 of a percentage point).

It is a continuation of an anti-inflation strategy that’s likely to visit disproportionate pain on poor and working class households— households amongst which, because of historical and continuing racial exploitation, Blacks are disproportionately concentrated.

It’s a strategy that weaponizes joblessness in the name of securing price stability.

It’s a strategy that “moves” poor and working class folk to the front of the line of those to be sacrificed at the altar of price stability.

In his press conference after the December meeting, as well as in the Fed’s December Summary of Economic Projections, Powell makes it abundantly clear that the Fed is still not sufficiently convinced that we’ve turned the corner on inflation and we should therefore some more rate increases in 2023.

All in all, the Fed is projecting both low GDP growth and increased joblessness for the next few years.

The official unemployment rate, for instance, is projected to rise from its current rate of 3.7% to 4.6% in 2023 and 2024, with a slight tick downward to 4.5% in 2025.

If you take the time to peer beneath the technical and abstract language that characterizes “Fed-Talk,” you’d realize that the Fed, in effect, is projecting that the ranks of the unemployed will swell by an additional 1.6 million persons by the end of 2023.

And that’s not all.

Historically, the Black has tended to be twice as high as the aggregate unemployment rate. So, an overall unemployment rate of 4.6% translates into a Black jobless rate of over 9 percent.

So, again, when you get beyond the technical language that often surrounds economics in general and monetary policy in particular, the message you hear is striking and ought to make the hairs on your neck stand to attention: Fighting today’s inflation will require throwing millions of persons into the economic pits, and Black folk will be especially likely to get burnt.

While, as mentioned above, inflation may have an especially pernicious impact on those least able to bear the weight, the Fed’s anti-inflation strategy of hiking its interest rate to secure price stability is likely to incite a recession.

That’s a cure that’s just as bad, if not worse, than the disease.

And that’s bad news for workers, and especially for Black ones.

REJECTING PYP ECONOMICS

The last thing we need from the Fed right now is further rate increases. At least if we have a modicum of genuine concern about the poor, the working class, and Black and Brown communities.

It cannot be emphasized enough that these rate increases put us on a road that leads to a recession and place the most economically fragile directly in the line of fire. And, as mentioned above, even the Fed admits that the current economic trajectory is likely to throw well over a million additional persons into the pit of joblessness, although they shroud that admission by in econo-speak.

So, what do we need to do?

Well, one of the things we need to do is to reject PYP economics as the antidote to today’s current bout of inflation.

PYP economics “solution” is both simple and dangerous.

It says that the only way we can bring inflation down is by jacking up joblessness.

It says that we must be prepared to line up millions of workers for a sacrificial offering to the god of price stability.

It says that we must be willing to tolerate the fact that Black and Brown folk will be disproportionately concentrated and at the front of the queue of those to be sacrificed.

And, as I’ve repeatedly emphasized throughout this post, the Fed’s anti-inflation strategy is a paradigmatic expression of PYP economics.

What we need is both price stability and full employment.

We don’t need—nor should we accept— the counsel of those we insist that the only way to ease the burden of inflation upon the poor and working class is by increasing the weight of joblessness upon their shoulders.

We don’t need—nor should we accept— the counsel of those who insist that our only choice is between a combo of high unemployment and low inflation and low unemployment and high inflation

We must fight for both price stability and full employment.

And, believe it or not, we can have both.

Today’s inflation can be tamed without inciting a recession and the human carnage that comes in its wake.

And although it’s beyond the scope of this blog, let me drop these links real quick that’ll point you to some policies that can help to put a lid on inflation without increasing joblessness among the poor and working class.

Check out this one by economist Claudia Sahm.

And this one by Joseph Stiglitz and Ira Regmi.

In the meantime, know this: If there’s a recession that appears after all this smoke clears it will not be because of the operation of some imagined iron law of economics. Nor will it be because of some alleged impossibility of tamping down without throwing millions more into joblessness.

If a recession does occur, it’ll be because policy makers—in this case the FED— decided to do something that’s long been the case in this nation— that is, to make peace with sacrificing the well-being of the poor and working class for some supposed greater good.

Comments